Talk to Gino Mantua Today!

Medicare Supplements

with Gino to review your options.

Talk to Gino Mantua Today!

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, also known as Medigap, is offered by private insurance companies to help cover the “gaps” in Original Medicare. These gaps include out-of-pocket costs like copayments, coinsurance, and deductibles.

With a Medigap policy, Medicare pays its share of approved healthcare costs first, and then your Medigap plan helps cover the rest—giving you more predictable healthcare expenses and added peace of mind.

What Does Medigap Cover?

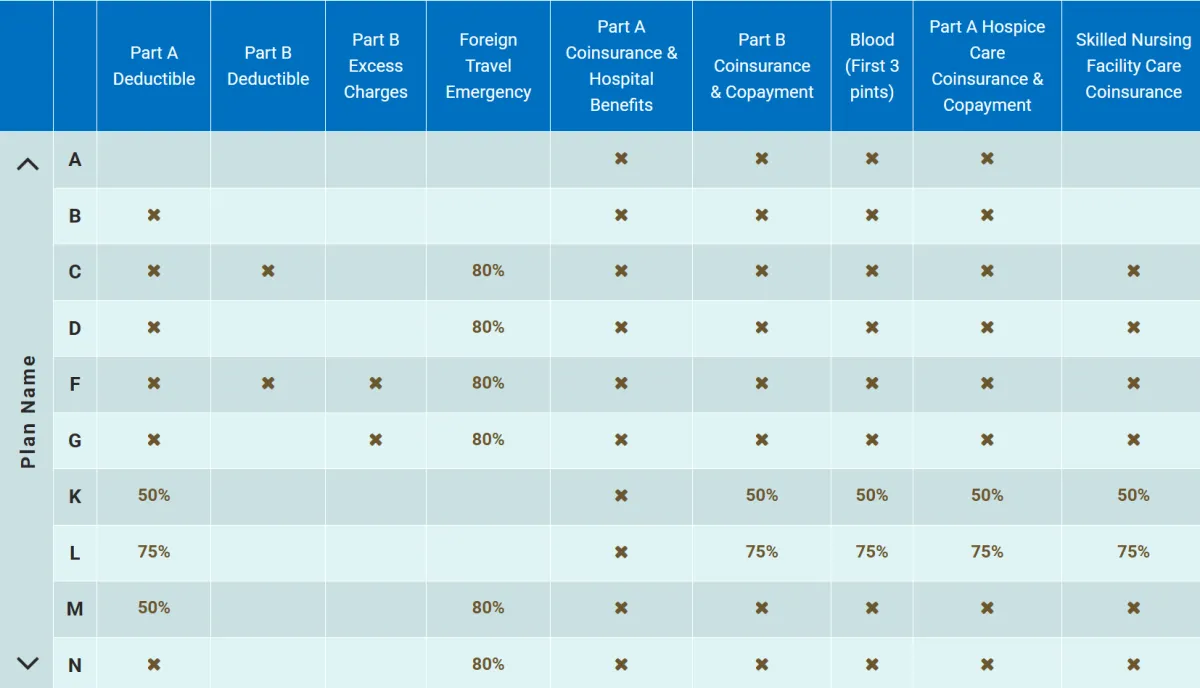

Depending on the plan you choose, a Medigap policy can help

pay for: Medicare Part A and B deductibles Copayments and coinsurance Skilled nursing facility care Emergency medical care while traveling outside the U.S.

Please note: Medigap plans do not include prescription drug coverage. If you need drug coverage, you’ll want to enroll in a separate Medicare Part D plan.

Medigap vs. Medicare Advantage

It’s important to know the difference:

Medigap supplements your Original Medicare benefits (Parts A and B). Medicare Advantage (Part C) replaces Original Medicare and often includes extra benefits.

You cannot have both a Medicare Advantage Plan and a Medigap policy at the same time.

Is a Medigap Plan Right for You?

If you want the flexibility to see any doctor or hospital that accepts Medicare and prefer predictable out of-pocket costs, a Medigap plan could be a great fit.

8 Key Things to Know About Medigap (Medicare Supplement) Policies

1. You Must Have Original Medicare to buy a Medigap policy, you must be enrolled in both Medicare Part A and Part B.

2. Switching From Medicare Advantage If you have a Medicare Advantage Plan, you can apply for a Medigap policy—but you’ll need to leave your Advantage Plan before the Medigap coverage begins.

3. You’ll Pay an Additional Premium Medigap policies have a monthly premium paid to the private insurance company. This is in addition to your monthly Part B premium paid to Medicare.

4. Medigap Covers One Person Each Medigap policy only covers one person. If both you and your spouse want coverage, you'll each need your own policy.

5. Buy From Any Licensed Insurer in Your State You can purchase a Medigap plan from any insurance company licensed to sell in your state.

6. Guaranteed Renewable As long as you pay your premiums, your Medigap policy is guaranteed renewable—even if you develop health problems.

7. No Drug Coverage in New Plans Medigap policies sold after January 1, 2006, do not include prescription drug coverage. You’ll need to enroll in a separate Medicare Part D plan if you want help with medication costs.

8. Medigap and MSA Plans Don’t Mix If you’re enrolled in a Medicare Medical Savings Account (MSA) Plan, it’s illegal for anyone to sell you a Medigap policy.

________________________________________

What Medigap Doesn’t Cover

Medigap policies generally do not cover:

• Long-term care

• Vision or dental services

• Hearing aids or eyeglasses

• Private-duty nursing

• Prescription drugs (sold after 2006)

________________________________________

Not All Insurance Is Medigap

The following types of insurance are not Medigap plans:

• Medicare Advantage Plans (HMO, PPO, PFFS)

• Medicare Prescription Drug Plans (Part D)

• Medicaid

• Employer or union group plans (including FEHBP)

• TRICARE or VA benefits

• Long-term care insurance

• Indian Health Service or Tribal Health plans

________________________________________

Thinking About Dropping Medigap?

If you decide to drop your entire Medigap policy (not just drug coverage), plan ahead. Switching to another Medigap policy or a Medicare Advantage Plan with drug coverage is possible—but timing matters.

Important:

If you go more than 63 days without creditable prescription drug coverage, you could face a late enrollment penalty when you join a Medicare Part D plan.

________________________________________

Have questions or need help reviewing your options? Contact us today for a free, no-pressure consultation. We’re here to help you make sense of it all.

Find Plans

Navigating insurance options can feel overwhelming—but it doesn’t have to be. At Mantua Insurance Group, we make it easy to compare and explore a wide range of Health, Life, and Medicare plans from trusted providers. Whether you’re new to coverage, reviewing your current policy, or exploring options for a loved one, we’re here to help you find a plan that fits your needs, budget, and lifestyle.

Use our tools, resources, and expert guidance to confidently choose the plan that’s right for you.

Find Plans

Medicare Resources

Medicare Resources

Talk to Gino Mantua Today!

GOOD PLAN

$XXX

Per month

Health Insurance

Accident

Dental

Vision

BETTER PLAN

$XXX

Per month

Health Insurance

Accident

Sickness

Critical Illness

Dental

Vision

BEST PLAN

$XXX

Per month

Liability Insurance

Health Insurance

Education Insurance

Business Insurance